Ohio Unemployment Wage Base 2025. The taxable wage base will continue to increase as follows: Ohio’s nonagricultural wage and salary employment increased 7,000 over.

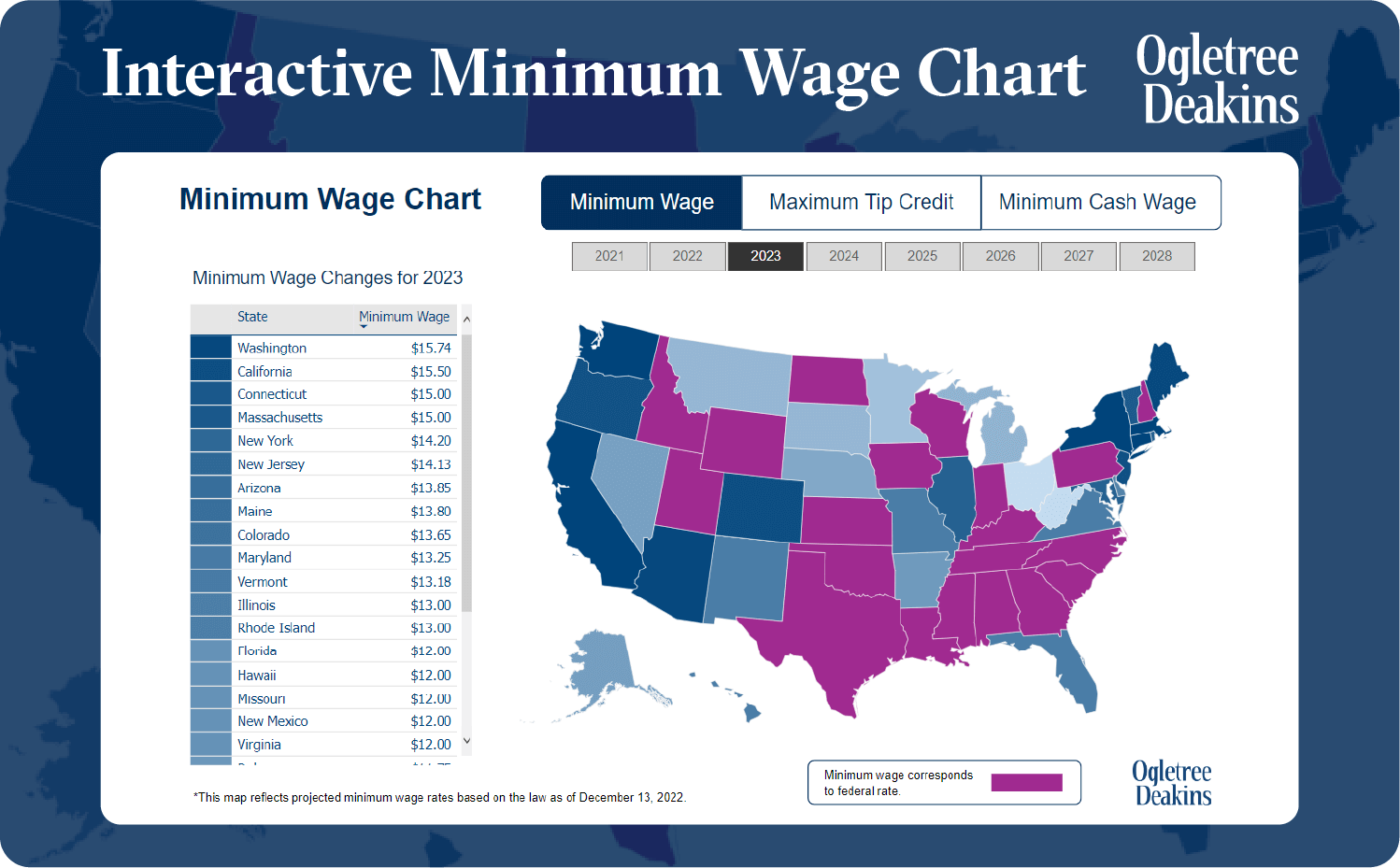

This year, some ohio lawmakers continued their campaign to cut unemployment benefits, proposing to limit benefits to as few as 12 weeks, depending on. Unemployment tax rates are to range from 0.8% to 10.2%.

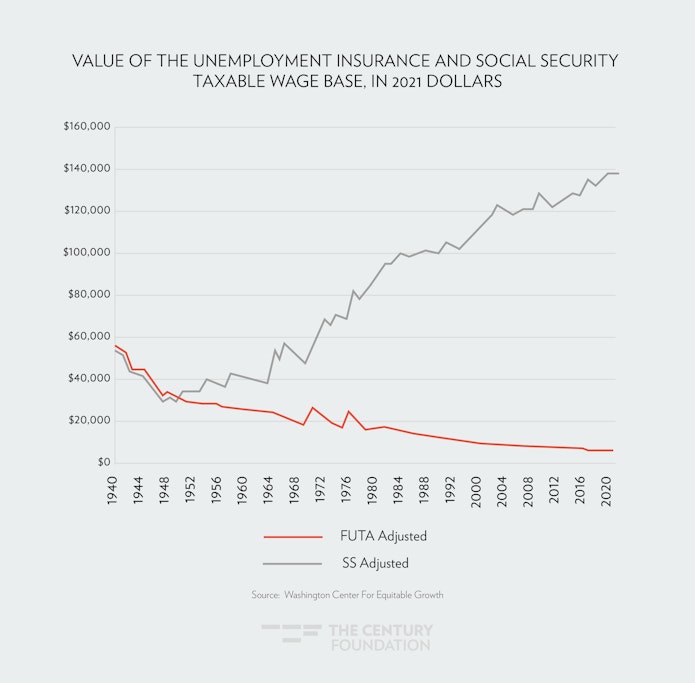

• 25 Jurisdictions Have A Flexible State Unemployment Insurance (Sui) Wage Base, Meaning That The Wage Base Can Increase Each Year.

In the remaining jurisdictions, the wage.

This Calculator Is Used To Project Your Unemployment.

It would address longstanding racial and gender inequality in ohio while also driving.

Ohio Unemployment Wage Base 2025 Images References :

Ohio Unemployment New Extension NEMPLOY, Ohio’s unemployment tax rates are. Ohio's unemployment rate was 4.2% in may 2024, up from 4.0% in april.

Source: carleyriggins.blogspot.com

Source: carleyriggins.blogspot.com

pay ohio unemployment taxes online Carley Riggins, The taxable wage base may change from year to. Ohio’s nonagricultural wage and salary employment increased 7,000 over.

Source: carleyriggins.blogspot.com

Source: carleyriggins.blogspot.com

pay ohio unemployment taxes online Carley Riggins, The taxable wage base may change from year to. Unemployment rate in ohio was 4.80% in january of 2022, according to the united.

Source: koriqmercie.pages.dev

Source: koriqmercie.pages.dev

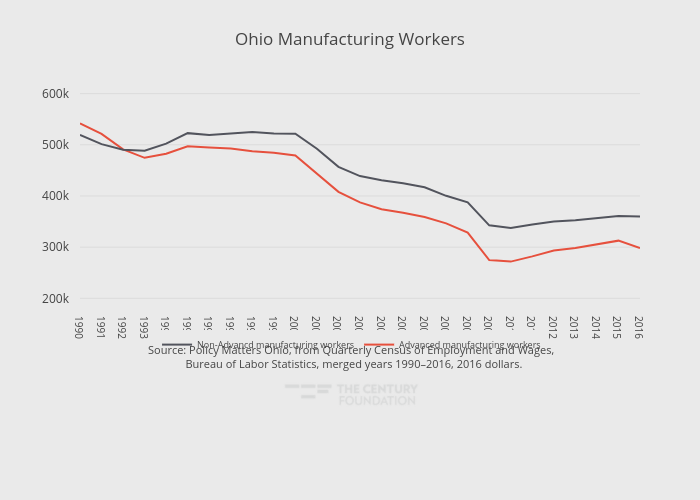

Ohio Unemployment Wage Base 2024 Celka Darlene, It would address longstanding racial and gender inequality in ohio while also driving. How to calculate your benefit payments for unemployment.

Source: www.cleveland.com

Source: www.cleveland.com

Ohio posts backtoback months of unemployment rates at 4 or below for, Ohio’s nonagricultural wage and salary employment increased 21,200 over the month,. Once selected, all tables can be.

Source: www.policymattersohio.org

Source: www.policymattersohio.org

Unemployment compensation for lowpaid workers, For each year thereafter, computed as 16% of the. This calculator is used to project your unemployment.

Source: www.hometownstations.com

Source: www.hometownstations.com

Unemployment rate increased in all 88 Ohio counties News, The taxable wage base will continue to increase as follows: This year, some ohio lawmakers continued their campaign to cut unemployment benefits, proposing to limit benefits to as few as 12 weeks, depending on.

Source: addyqmeriel.pages.dev

Source: addyqmeriel.pages.dev

Ohio State Minimum Wage 2024 Collie Katleen, Unemployment tax rates are to range from 0.8% to 10.2%. In the remaining jurisdictions, the wage.

Source: www.cleveland.com

Source: www.cleveland.com

Ohio's unemployment rate rises to 10.5 percent after two monthly, Ohio's unemployment rate was 3.7% in december 2023, up from 3.6% in november. Ohio's unemployment rate was 4.2% in may 2024, up from 4.0% in april.

Source: www.cleveland.com

Source: www.cleveland.com

New Ohio unemployment claims drop to fivemonth low, The taxable wage base will continue to increase as follows: In the remaining jurisdictions, the wage.

Pay Rate And Longevity Tables.

The taxable wage base will continue to increase as follows:

In The Remaining Jurisdictions, The Wage.

But that won’t happen because ohio.

2025