Ohio 529 Max Contribution 2024. Do you have questions about ohio’s 529 plan? Individuals may contribute as much as $90,000 to a 529 plan in 2024 ($85,000 in 2023) if they treat the contribution as if it were.

Individuals may contribute as much as $90,000 to a 529 plan in 2024 ($85,000 in 2023) if they treat the contribution as if it were. But while there’s no federal.

Ohio 529 Max Contribution 2024 Images References :

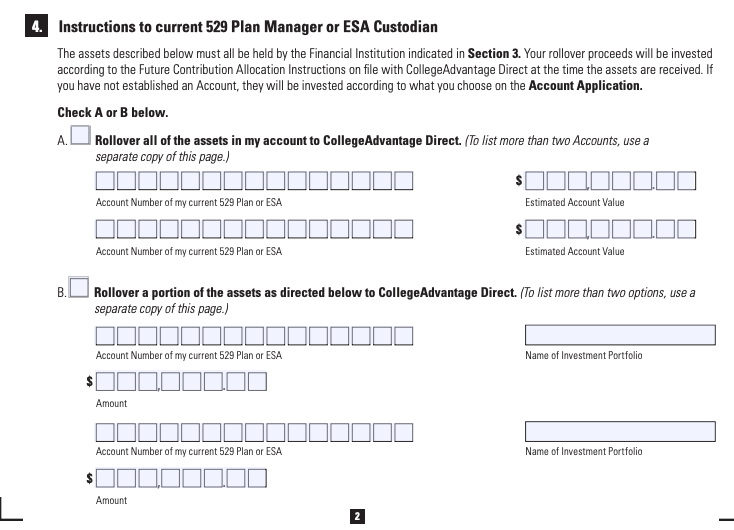

Source: collegeadvantage.com

Source: collegeadvantage.com

Learn About Ohio 529 Plan CollegeAdvantage, Contribution limits for 529 plans range from around $235,000 on the low end to more than $550,000 per beneficiary.

Source: lesyaqmichaela.pages.dev

Source: lesyaqmichaela.pages.dev

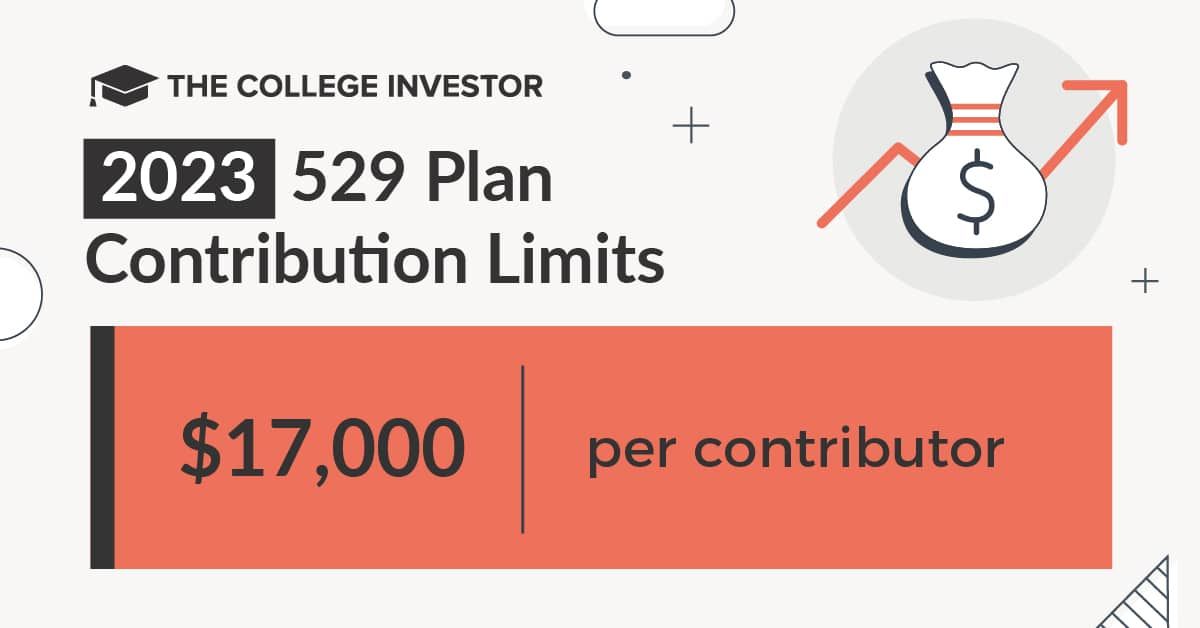

529 Limits 2024 Elset Horatia, Individuals may contribute as much as $90,000 to a 529 plan in 2024 ($85,000 in 2023) if they treat the contribution as if it were.

Source: kimberlynwalvera.pages.dev

Source: kimberlynwalvera.pages.dev

Irs 529 Contribution Limits 2024 Rory Walliw, 529 contribution limits are set by states and range from $235,000 to $575,000.

Source: www.elementforex.com

Source: www.elementforex.com

529 Plan Contribution Limits For 2023 And 2024 Forex Systems, First, a 529 account must be open for the beneficiary for 15 years.

Source: www.savingforcollege.com

Source: www.savingforcollege.com

How to Switch 529 Plans, Do you have questions about ohio’s 529 plan?

Source: www.youtube.com

Source: www.youtube.com

529 Plan Maximum Contributions YouTube, First, a 529 account must be open for the beneficiary for 15 years.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

What To Do With Leftover Money In A 529 Plan?, This increase heightens the advantages.

Source: www.youtube.com

Source: www.youtube.com

529 Plan Contribution Limits Rise In 2023 YouTube, This increase heightens the advantages.

:fill(white):max_bytes(150000):strip_icc()/my529-logo-5f7fa97efbfb493faf2a92b1c00d42ac.png) Source: www.investopedia.com

Source: www.investopedia.com

Best 529 Plans for College Savings of 2024, In 2018, the state income tax deduction for contributions made to ohio’s 529 plan doubled from $2,000 to $4,000 per beneficiary, per year.

Source: www.mybikescan.com

Source: www.mybikescan.com

2024 529 Contribution Limits What You Should Know MyBikeScan, Individuals may contribute as much as $90,000 to a 529 plan in 2024 ($85,000 in 2023) if they treat the contribution as if it were.

Posted in 2024